Venture capital, a crucial aspect of modern economies fostering innovation and growth, has found fertile ground in Germany. This article delves into the multifaceted landscape of the German venture capital market, exploring the myriad opportunities it offers alongside the formidable challenges investors encounter.

Growth and Evolution of Venture Capital in Germany

Historical Context

Germany’s journey in venture capital traces back to its renowned engineering and industrial heritage. While the country has long been synonymous with innovation, the venture capital scene took time to burgeon, mirroring the cautious, methodical approach often associated with German business culture.

Recent Trends and Developments

In recent years, however, Germany has witnessed a remarkable surge in venture capital activity. This growth can be attributed to several factors, including a burgeoning startup ecosystem, increased international interest, and supportive government policies. Notably, Berlin has emerged as a vibrant tech hub, attracting talent and investment from across the globe.

Opportunities in the German Venture Capital Market

Tech Sector Boom

The cornerstone of Germany’s venture capital market lies in its burgeoning tech sector. Fueled by a confluence of factors such as access to top-tier engineering talent, robust infrastructure, and a supportive regulatory environment, startups in areas like fintech, biotech, and e-commerce have thrived. Notably, Berlin’s Silicon Allee has become synonymous with innovation, rivaling established tech hubs like Silicon Valley.

Government Support and Initiatives

The German government has played a pivotal role in nurturing the country’s startup ecosystem. Through a myriad of initiatives, such as tax incentives, grants, and startup visas, policymakers have sought to create an environment conducive to entrepreneurial success. These efforts have not only attracted domestic talent but also positioned Germany as an attractive destination for foreign investors.

Challenges Faced by Investors

Regulatory Hurdles

Despite its allure, navigating Germany’s regulatory landscape can be daunting for venture capital investors. The country’s complex tax laws, bureaucratic red tape, and stringent compliance requirements pose significant challenges, particularly for foreign firms seeking to enter the market. Moreover, regulatory uncertainty stemming from Brexit and evolving EU directives adds another layer of complexity.

Cultural Differences

Beyond regulatory challenges, investors must navigate cultural nuances inherent to doing business in Germany. Building trust and forging relationships with local stakeholders is paramount, requiring an understanding of German business customs and communication styles. Failure to grasp these subtleties can hinder deal-making and hinder long-term success.

Read More: The German Eurozone Crisis: Lessons Learned

Strategies for Success in the German Venture Capital Market

Building Strong Networks

Networking is critical to success in the German venture capital landscape. Establishing connections with entrepreneurs, industry insiders, and government officials can provide invaluable insights and opportunities for collaboration. Attending industry events, joining professional organizations, and leveraging social platforms can help investors broaden their network and unlock new opportunities.

Understanding Local Dynamics

To thrive in the German market, investors must possess a nuanced understanding of local dynamics. This includes familiarizing themselves with consumer preferences, market trends, and regulatory frameworks specific to Germany. Tailoring investment strategies to align with these nuances not only enhances the likelihood of success but also fosters trust and credibility within the local ecosystem.

Case Studies of Successful Ventures

Examples of Thriving Startups

Numerous success stories underscore the vibrancy of the German venture capital market. Companies such as Delivery Hero, a global leader in food delivery services, and N26, a digital bank, have achieved unicorn status, attracting substantial investment and expanding their reach internationally. These success stories serve as inspiration for aspiring entrepreneurs and investors alike, showcasing the potential of the German startup ecosystem.

Future Outlook and Predictions

Emerging Sectors

Looking ahead, emerging sectors such as artificial intelligence, clean energy, and digital health are poised to drive the next wave of innovation in the German venture capital market. Advances in technology, coupled with shifting consumer preferences and regulatory reforms, present new avenues for investment and growth. Investors who position themselves strategically within these burgeoning sectors stand to reap substantial rewards.

Potential Obstacles

However, challenges loom on the horizon, ranging from geopolitical tensions to economic volatility and regulatory uncertainty. Navigating these obstacles will require agility, adaptability, and a keen understanding of market dynamics. Moreover, as the global landscape evolves, investors must remain vigilant, continuously reassessing their strategies to mitigate risks and capitalize on emerging opportunities.

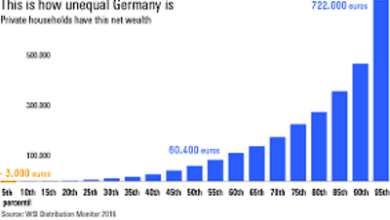

Read More: Wealth Inequality in Germany: Impact on Financial Planning

Conclusion

In conclusion, the German venture capital market presents a wealth of opportunities for investors seeking high-growth prospects and innovation. Despite the challenges posed by regulatory hurdles and cultural differences, the country’s dynamic ecosystem, bolstered by government support and entrepreneurial talent, continues to attract investment and drive progress. By leveraging strategies tailored to the local landscape and staying abreast of emerging trends, investors can position themselves for success in this dynamic and ever-evolving market.

FAQs

How does Germany’s venture capital market compare to other European countries?

Germany’s venture capital market is among the largest in Europe, buoyed by a vibrant startup ecosystem and supportive government policies. While countries like the UK and France have historically dominated the European startup scene, Germany’s rapid growth and technological innovation position it as a formidable contender on the global stage.

What role does government support play in fostering innovation in Germany?

Government support plays a crucial role in fostering innovation and entrepreneurship in Germany. Through initiatives such as tax incentives, grants, and startup visas, policymakers have created an environment conducive to startup growth and investment, attracting talent and capital from around the world.

What are some key sectors driving growth in the German venture capital market?

Key sectors driving growth in the German venture capital market include technology, biotech, fintech, and e-commerce. These sectors benefit from Germany’s strong engineering talent pool, robust infrastructure, and favorable regulatory environment, making them attractive investment opportunities for both domestic and international investors.

How do cultural differences impact venture capital investment in Germany?

Cultural differences can impact venture capital investment in Germany, as building trust and relationships with local stakeholders is essential for success. Understanding German business customs, communication styles, and decision-making processes can help investors navigate these cultural nuances and forge meaningful partnerships.

What are some strategies for mitigating regulatory risks in the German venture capital market?

Mitigating regulatory risks in the German venture capital market requires thorough due diligence and compliance efforts. Working closely with legal experts familiar with local laws and regulations, maintaining open communication with regulatory authorities, and staying abreast of changes in the regulatory landscape are essential strategies for investors seeking to navigate regulatory complexities effectively.